About 'us state debt'|...of democratic nations above Personally - I'd love for Mexico to wipe its' debt to the US and give the state of Israel a 500 year lease on Baja California. Not going happen. Since 1948...

Arkansas, officially nicknamed "The Natural State" with its mountains, valleys, dense woodlands, plains, clear lakes and streams, and abundant wildlife, is a popular tourist state. And with its beautiful scenery, Arkansas has a mild climate, while still offering four distinct seasons, a high quality of life, and a low cost of living, making it an attractive option for retirees. According to America's best places to retire, the median price of a home in Arkansas is $79,006. Top Retirements reports a median price of a home of $168,400 in the Lafayette/Rogers/Springdale area, with a cost of living index of 85 on a national scale of 100. In Hot Springs the median home price is $114,000 and the cost of living index is 81. The low cost of living compensates for the relatively high state and local tax burden. The Tax Foundation ranked Arkansas 14th among the states in terms of the overall state and local tax burden for 2008. Arkansas state income tax Arkansas has a state individual income tax with rates starting at 1% on the first $3,799 of taxable income, up to 7% on taxable income over $31,700. The standard deduction is $2,000 for single, head of household, married filing separately and qualifying widow(er), and $4,000 for married filing jointly. Social Security benefits, VA benefits, workers' compensation, unemploy¬ment compensation, Railroad Retire¬ment benefits and related supple¬mental benefits are exempt from Arkansas state income tax. The first $6,000 of income you receive from an employer sponsored retirement plan, including disability retirement is exempt. Also, if you are over 59 ½, the first $6,000 you receive as a traditional IRA distribution is exempt. Interest you receive on U.S., Arkansas, or local government bonds or other debt obligations is exempt from Arkansas income tax. Arkansas property taxes Property taxes in Arkansas are levied by the counties, cities and school districts on real property, such as your home and land, and on certain personal property including automobiles, pickup trucks, recreational vehicles, boats and motors, motorcycles, and all-terrain vehicles. The property tax is calculated as 20% of the true market value times the local millage rate. You can find the local millage rates in the State of Arkansas Millage Report. The state average, including school district and city taxes, was 46.69 mills for 2008, that is, $46.69 for each $1,000 of assessed value (20% of market value). The assessed value of homesteads is not increased more than 5% above the previous taxable assessed value except when you make additions or substantial improvements to the property. After you reach age 65 or are disabled, the assessed value is capped at the previous year's value unless improvements are made or the property is sold. Disabled veterans are generally exempt from state taxes on real and personal property. This exemption also applies to widows or widowers who do not remarry, and to dependent minor children of military personnel who were killed in action, died of service-related disabilities, or who are missing in action. All Arkansas homeowners can receive up to a $350 homestead tax credit against the property taxes on their principal residence. Arkansas sales tax Arkansas has a 6% state sales tax, and according to the Retirement Living Information Center, city and county sales taxes could add an additional 6.5%. Prescription drugs are exempt from sales tax. There is a 3% sales tax on food, and 4.5% on natural gas and electricity. According to Bankrate.com, various services are also subject to sales tax, including wrecker and towing services, dry cleaning and laundry, pest control, security and alarm monitoring, self-storage facilities, boat storage and docking, and pet grooming and kennel services. Arkansas estate tax There is no inheritance tax in Arkansas. And the Arkansas estate tax is repealed in conjunction with the repeal of the federal credit for state death taxes for the estates of decedents dying on or after January 1, 2005. For deaths prior to that date, the state estate tax is based on federal estate tax law. The Arkansas tax is equal to the credit allowed for federal estate tax purposes. Since the Arkansas tax is offset by the federal tax credit, there is no additional estate tax burden on the decedent's estate. Sources: Arkansas Individual Income Tax Forms and Instructions - Arkansas Department of Finance and Administration Bankrate - State Tax Roundup - Arkansas Retirement Living Information Center - Taxes by State - Arkansas Tax Foundation - Arkansas' State and Local Tax Burden, 1977-2008 |

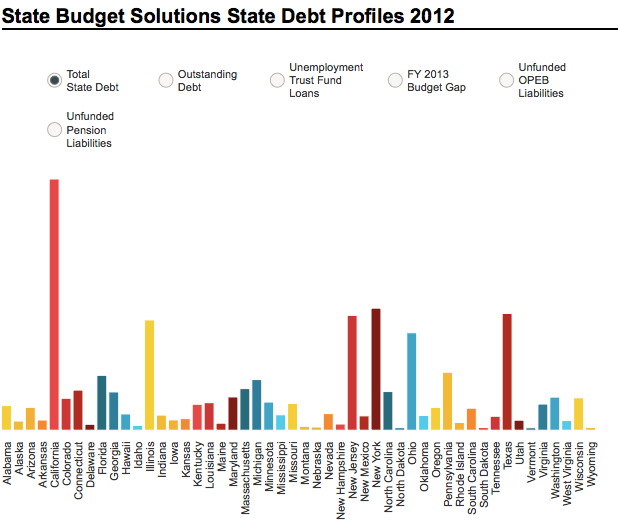

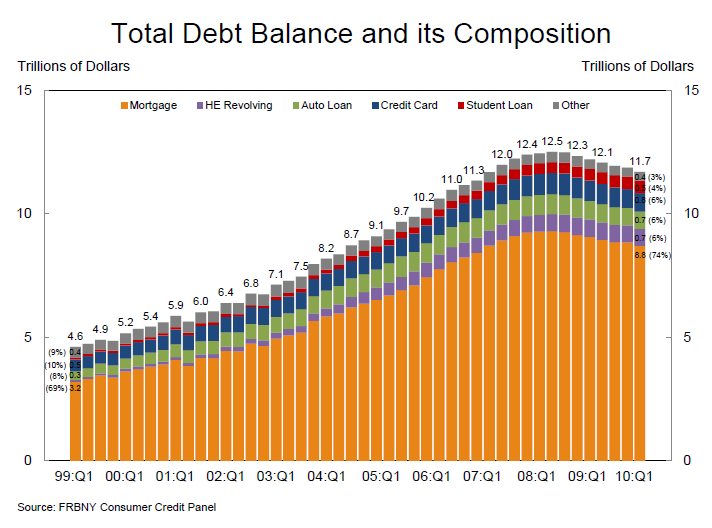

Image of us state debt

Related blog with us state debt

- pissedoffwoman.wordpress.com/... of the population of a State, without its consent and with full...illegitimacy in contracts of debt to predatory international ...Ecuador’s domestic laws, US Securities and Exchange...

- jcolomer.blogspot.com/...comparable to what the first Treasury secretary, Alexander Hamilton, did in the US with the states’ debt –even with the advantage regarding the US in the late 18 th century that...

- rosenthalcapital.blogspot.com/...director of the National Association of State Budget Officers. ...the US$'s strength as well as the strength in...in Europe. The fears of a debt default in Greece have led some to believe...

- barry-julie.blogspot.com/...capability to breach a hypothetical US missile defense system,” he...next year. The United States is building... in a note. The sovereign debt crisis that has ...

- purplepinupguru.blogspot.com/...of democratic nations above? Personally - I'd love for Mexico to wipe its' debt to the US and give the state of Israel a 500 year lease on Baja California. Not going happen. Since 1948...

- churlsgonewild.wordpress.com/... heavy debt obligations to the US Treasury. Over the..., the US State and Treasury...the Ottoman Public Debt Administration , or...Commission. In 1922 the US State Department ...

- abluespot.blogspot.com/...He is against allowing us to elect our own Senators The...He staved off larger debt by shifting state sponsored education funding...

- www.nakedcapitalism.com/...from other tax sources or borrowing. In addition to Federal debt, US State governments and municipalities have debt of around $3 trillion. Apolitical...

- stevenbirnspeaks.wordpress.com/...2011 Leave a Comment The 50 US states have debts totaling around $4 trillion...environment. With $4 trillion in state debts something needs to be...

- olcranky.wordpress.com/...Economics , Foreign Affairs , government , history , Politics Tagged as California debt , debt ceiling , Geithner , National debt default , Obamanomics , States debt default , US debt , US economy

Us State Debt - Blog Homepage Results

Related Video with us state debt

us state debt Video 1

us state debt Video 2

us state debt Video 3