About 'us debt problem'|Chinese Ownership of US Debt - Facing The Problem

What is Debt ceiling? How does that effect your personal Debt management? Can you payoff Credit Card Debt or other debts or even do Debt consolidation regardless of any changes that might occur? If you have been watching the news! the words "Debt ceiling" has been coming up with great frequency and suggests larger Debt problems in the USA. Does that spell into greater problems for the US economy? How about the Canadian economy? The answer to that is as usual, it depends. Let us look at it from a personal finances point of view. Is there a Debt ceiling for personal Debt? more importantly, should you have a Debt ceiling for you personal finances? the answer to those questions is a big YES. How do you find out what it is? Calculate your Debt to income ratio. This is not a simple answer. Is it? Well, let us try to simplify this; ask yourself, if you go to the Bank and ask for additional Credit facility, would the bank extend your credit or deny it? and why would they accept or deny the request for additional Credit? The Bank will do an assessment of your total current Debts , get an idea of your Expenses and compare it to your Income and Assets. Here are quick ways for you to get a quick answer Are you making only minimum payments on your credit card? Are you able to payoff Debts that you are currently carrying within a planned period of time? Are you getting calls from collection agencies? Has any change occurred in your job situation? Has any change occurred in your personal life? If you answered Yes to any of the above, raise (1) one flag. If you answered Yes to more than one of the above then raise (2) two flags. You get the idea. So how does the economy effect your personal situation? well, if we keep increasing the size of the Debt our long term ability to get rid of this Debt becomes less viable. It is like your personal health, if you keep buying larger size dresses or pants to fit your new weight increase, then your ability to shed off this weight gets harder. Personal debt is no different. Initially, Debt amounts may seem manageable, the Debt problem gets worse as interest keeps adding up. For you to keep on top of your financial situation, use redly available tools that helps you track your Debts like a self help work sheet , use the link for one we put together. Or use on-line tools that provide a good estimate if there is a change in the amount of Debt, increase in interest rates, even what would be a good amount to pay monthly on your Debts, try our free Debt Calculator. Debt Ceiling is a measure for your own ability to handle your Debts and particularly the unsecured Debt. Set your own limit and ceiling as it pertains to your own situation. when in doubt talk to the experts in Debt Management and take advantage on any free counseling and assessments. |

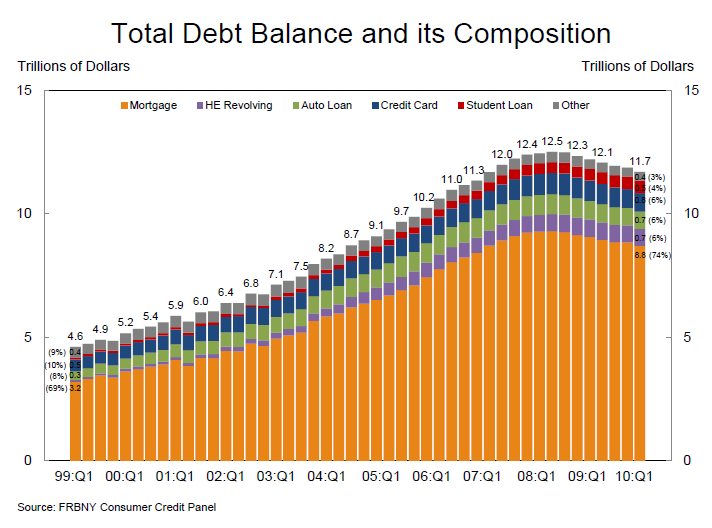

Image of us debt problem

us debt problem Image 1

us debt problem Image 2

us debt problem Image 3

us debt problem Image 4

us debt problem Image 5

Related blog with us debt problem

- kopsaottekeepingyouinformed.blogspot.com/...in the local paper and Tom Purcell from the Omaha World Herald is spot on with the US debt problem. He does a great job of summarizing the issues. To read his...

- www.nakedcapitalism.com/... that the US, a sovereign issuer...a household. The problem is first...Russian government debt outstanding.... The US debt problems resemble Agatha Christie...

- salthair.wordpress.com/OK, clearly there is a US debt problem. There’s a problem because the world economy...reason we are having this debt crisis in the US isn’t because market events...

- whispersfromtheedgeoftherainforest.blogspot.com/... excellent animation of the US debt problem. Forgotten in much of...3. But halting all new debt issuance does't end the problem. $467.4 billion has to...

- iidaily.wordpress.com/...absolute confidence that the US would never again be ... massive financial problems in the banking and...a large overhang of government debt. Plausibly, private-sector financial...

- radioequalizer.blogspot.com/...And Guest: S&P Downgrade Merely Political, No US Debt Problem WE'RE A-'O'-K! Sharpton Show: Obama's US...s political! Of course, estimated US debt-to-GDP is actually 102.63% for 2011...

- josephtanega.blogspot.com/...inappropriate for a community of free persons” (1279a17–2) If we apply the above to the US debt problem, the obvious answer is that a "just" budget must aim at "common advantage" and any other...

- kerrycollison.blogspot.com/... the debt crisis won’t solve the bigger problems The American television... that even US politicians...by buying US debt. China is...

- laowaitimes.blogspot.com/... yuan. I would assume that Chinese and US policymakers are well aware...to take than to act upon them. The problem is that each side has been...

- coyoteprime-runningcauseicantfly.blogspot.com/“The Bigger Debt Problem: China’s Local Government Debt vs. US Subprime Debt” by Bill Bonner... than America’s subprime problem. Subprime debt in the US never surpassed 10...

Us Debt Problem - Blog Homepage Results

CIGby

...between Kuwait and Iraq and encourage the finality of debt-forgiveness from all parties Managing...business pact engineered by the ever-hawkish US Treasury team based in DC. With no love...

...a possibility. The only doctor that can cure the problem is the G20. The debt situation is far bigger than 1929 when many US citizens jumped on the stock bubble...

... threaten the US with default on its debt, his home State of Kentucky ... public health and environmental problems in the country. McConnell's Kentucky...

Related Video with us debt problem

us debt problem Video 1

us debt problem Video 2

us debt problem Video 3