About 'debt to gdp ratio us'|Whooooeeee! Belize Debt to GDP ratio is 58% says WIKIPEDIA calculation.

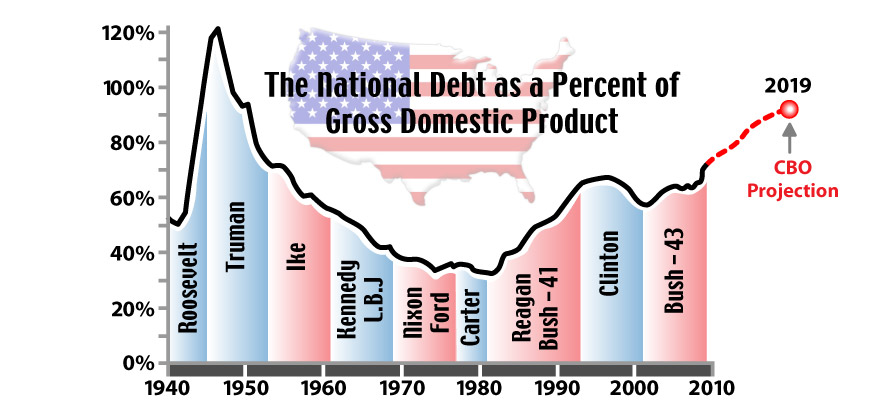

Okay, now I'm really worried. The market is in free-fall. I've seen dips described as crashes, even called some of them that myself. But the debt default in Greece prompted local panic. In my house, at least. Greece Greece's debt totals $473 billion. Its GDP is $330 billion, staking its debt ratio at 1.4 GDP. Remember that number as the point of Greece's financial collapse. U.S. Now I wish to point out that the U.S.'s debt ratio is 1.05. Remember that number too. We are not far behind Greece. Can you blame me for the panic right here at home? What does Greece have to do with us? Plenty. For those who question what this really means, let me share what little I know. Number one, I know that big debt isn't good. Did you recognize that pain in the pit of your stomach when you signed yourself into big debt like your mortgage? It's real. You indebted yourself for a big chunk of your life. Some folks realized at that moment they would be unable to pay it back, but they did it anyway. Smart ones waited until they could afford it. Not many of us are that smart. Number two, debt is taken on by nations in time of inescapably dire need. National debt typically rises during war, the most notable increases having occurred with the Revolutionary War, the Civil War, World Wars I and II. U.S. national debt spiked through the roof in the last two years, sparked more by wanton Federal spending than any inescapably dire national need. Third in the panic parade is that float called the debt ratio. Remember Greece's number? 1.4 GDP means that more than 100% of a country's ability to produce is required to pay off its debt. 1.4 GDP means that Greece will never be able to pay off its debt, at least not at current national production levels. 1.4 GDP means that Greece will default--taking most of the world's economy with it--unless somebody or something comes to its financial rescue. So far, nobody and nothing are stepping up to that plate. U.S. debt ratio heads upstairs It is this national debt ratio that set panic in my house as a reflection of the panic brewing across the country. Remember our nation's number? When national debt is more than the country can pay for with its production, we are in trouble. Remember, our number is 1.05 and rising. We are in trouble. But, hey, don't take my word for it. Wait for your own panic to set in. What's the solution? Two times in our history found the nation in similar trouble. The first was after the Revolutionary War. Alexander Hamilton's plan succeeded in paying down the debt. The second was after WW II. The nation's burst of industrial production, progress, and unencumbered capitalist advance paid down war debt in short order. What's going to pay down our debt now? Congress's solution is to raise the debt ceiling. Yeah, that'll do it. Where's our plan? Where's the burst of business or production to get us out of this mess? The solution is to cut federal spending, radically and right now! But that's something that's not done in D.C. And it might be too late. I find no way out of my panic. I am beyond consolation. Share what you know if you know something I don't. And please don't suggest I rely on hope or change. They aren't working for anybody right now. Sources: http://finance.yahoo.com/news/In-Greece-Some-See-a-New-nytimes-2124426573.html?x=0&sec=topStories&pos=main&asset=&ccode http://www.usgovernmentspending.com/federal_debt_chart.html |

Image of debt to gdp ratio us

Related blog with debt to gdp ratio us

- conscience-sociale.blogspot.com/... US public debt. The US Gov. has made some ... about the future country GDP up to 2016, just to explain that the debt to GDB ratio will remain constant (or "under control...

- conscience-sociale.blogspot.com/...linear since 2009 : the ratio increases...massive perfusion by debt monetization. Who...daily data from 2001 to 2012 and the ...since 1966, in % of GDP, chained... page about US Debt . 1Year data...

- justinhohn.typepad.com/blog/Moody’s expects to cut US rating without deal to lower debt/GDP ratio | ForexLive This could have a substantial negative impact on Obama's reelection efforts...

- rwer.wordpress.com/...1980 , and by doing so , fails to highlight the obvious political origins...at his graph above , from the peak in public debt/gdp ( and corresponding trough in private...

- startthinkingright.wordpress.com/...very much. Because that gives us a debt-to-GDP ratio of 100.5% by my calculation based...like this. Tags: bankrupt , debt , debt-to-GDP ratio , GDP , Greece , national debt This entry...

- uncleandystruthemporium.wordpress.com/... in the graphs below. The first depicts debt-to-GDP ratios for the US, Japan, and leading European Union economies, like the UK, Germany...

- westernbelizehappenings.blogspot.com/...GDP and profit margin. According to the CIA World Factbook, the 2010 public debt-to-GDP ratio in the US was 62.3% with a gross debt-to-GDP ratio of about 92.3%. [1] The level of...

- webabuser.blogspot.com/... as the US government struggled to come to an... the debt ceiling, and ... GDP, resulting... debt to GDP ratio of any of the...

- goldharvest.blogspot.com/... as the US government struggled to come to an... the debt ceiling, and ... GDP, resulting... debt to GDP ratio of any of the...

- totallygroovygirlfriday.wordpress.com/... debt to GDP ratio is not that...individual, corporate debt and GDP together in one graph... to say the least. ... that US GDP is ...

Related Video with debt to gdp ratio us

debt to gdp ratio us Video 1

debt to gdp ratio us Video 2

debt to gdp ratio us Video 3